Crotty market update: The S&P 500 surged through August, but will a double-top spell double-trouble come fall?

As we exit the Labor Day holiday after a summer bull run, we sit on the precipice of market-shaping events that could change the world as we know it. Here's what investors need to know.

August is historically a cruel month for investors, but this August was not. Though volatile, the S&P 500 benchmark index posted a 2.3% gain, with the Dow climbing 1.8% for the month and the Nasdaq Composite Index up 0.7%. It was not spectacular, but it was reassuring. August marked the fourth straight month of gains for the S&P. The year-to-date return for the SPY––the ETF that tracks the S&P 500 and the one holding I universally recommend to all novice investors assuming they auto-reinvest all SPY dividends––is over 20%. That’s 13% above its yearly average.

With U.S. Federal Reserve Chairman Jerome Powell signaling at least a 25-point federal funds rate cut in September, it would be natural to expect the bull run to continue. After all, cheaper money traditionally supports equities, especially for smaller-cap stocks, which fund their rapid growth through intense borrowing. Moreover, it could help loosen up a real estate market that’s been frozen in place with high prices and low churn since Bidenflation got rolling in earnest.

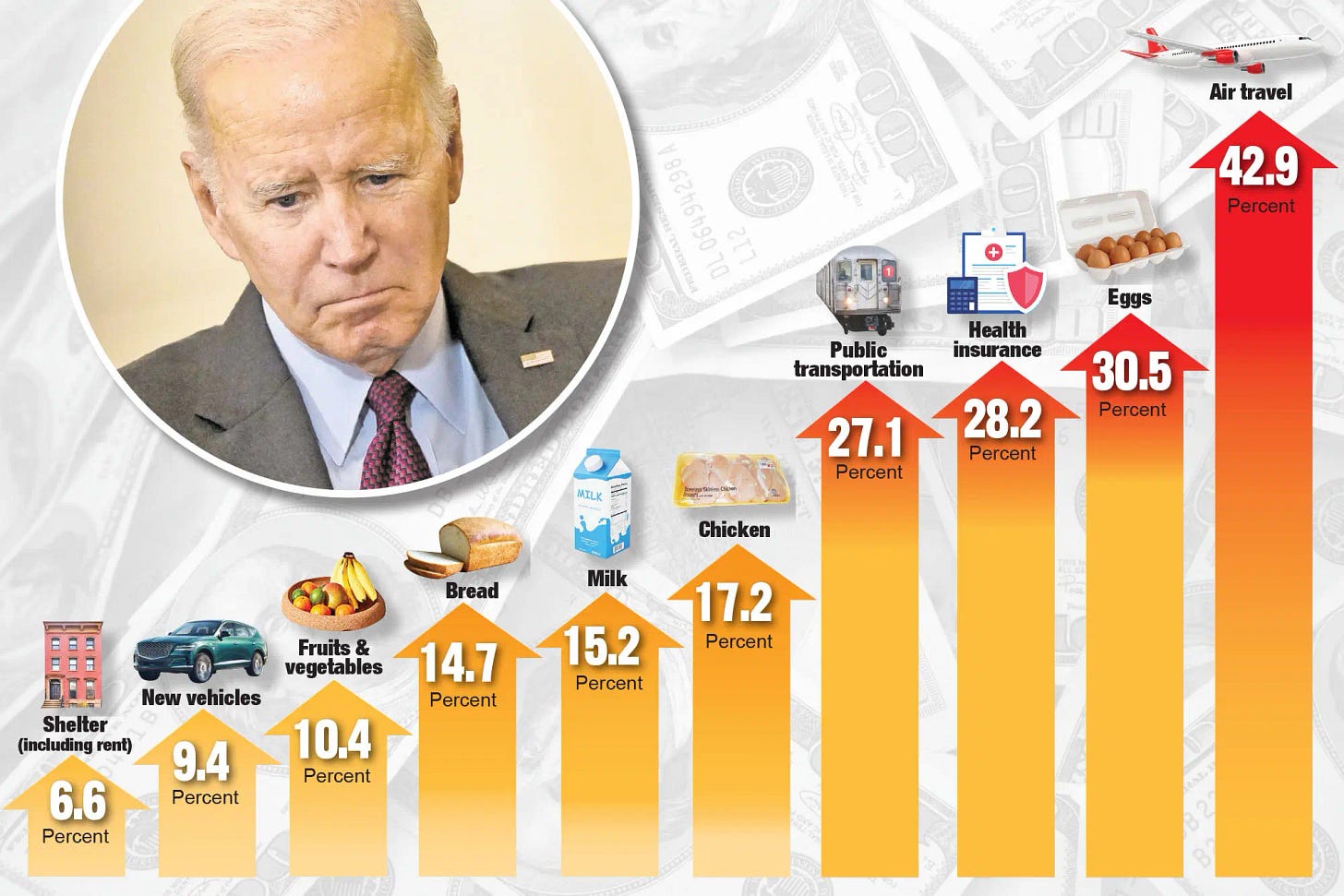

Contrary to the President’s revisionist history, he and Ms. Harris inherited a mere 1.4% inflation rate from Mr. Trump when they entered office in January 2021. This rate was below the 2% rate the Federal Reserve prefers to see to fend off recession. So, the Biden/Harris Administration had to spend hard to jack up the consumer price index to 9.1% and total inflation to 17.1% on their reckless watch.

Early in the Biden/Harris tenure, Barack Obama’s own Treasury Secretary, Larry Summers, warned of the dangers of new spending lest the inflation beast raise its head. Biden and Harris did not listen. Their deceitfully named $891 billion Inflation Reduction Act (IRA) did the opposite of its name while not even building out our nation’s electric vehicle charging infrastructure. With $75 billion allocated, seven charging stations have been built. When combined with the Administration’s work-disincentivizing $1.9 trillion American Rescue Plan, over $100 billion more in military and other aid to Ukraine and other nations, and regulations to slow or stop the production and sale of cheap, clean natural gas and liquid natural gas (LNG), the primary cause of the high prices Americans have experienced for three and half years has unequivocally been the Biden/Harris spending spree.

With Bidenflation decreasing due to draconian interventions from the Federal Reserve, investors might naturally feel optimistic. But that might be a tragic delusion. We currently are at or near what chart-watchers call a double-top in the SPY, defined as two recent peaks in price around the same level, separated by a moderate trough. A double-top forms when a stock or ETF fails twice to push through its latest price uptrend. This traditionally suggests that the stock or ETF has stalled and may be heading below its recent trough. It’s a highly bearish signal, especially when discussing the overall market barometer SPY.

If you talk to almost any random money manager, there seems to be a relatively strong consensus that the double top is here or near, and a massive correction sometime soon is in store. What goes up must come down. This bearish presumption is battling it out in the trenches with the equally strong presumption that a series of fall Fed rate cuts will light a further fire under equities and broaden the rally to include not only small-cap stocks and real estate but even riskier plays like cryptocurrencies. Happy times are here again!

I am not so buoyant, nor am I pessimistic. While a September double-top correction could be in the cards––and with political Svengali Marc Elias (Satan wasn’t available) advising Team Kamala, you can expect an attempt at an October Surprise––I still believe the election will conclude not with the feared bang but with an unexpected whimper. With rabid, taunting, foam-at-the-mouth Republican and Democratic partisans competing to see who can chug the most Kool-Aid, it will be a tiny cohort of moderate swing voters who will make the election-deciding decision over the next few weeks on which candidate is empirically best equipped to tackle the core issues facing the nation: a broken border, persistently high food and energy prices, unaffordable housing, violent crime, entrenched homelessness, drug addiction, and a world at war. Regardless of personalities, rallies, ads, celebrity endorsements, or debates, this cohort will vote early and conclusively on those kitchen table issues between mid-September and Election Day. They will not leave the country hanging as they did in 2000. You might say that election polling has also hit a double top and will resolve itself in one firm direction for one unlucky candidate.

Stock markets like certainty, and they will get it in November and adjust accordingly. So, after the election and a few Fed rate cuts, we will likely get a healthy upswing in equities into year-end, no matter who wins. SPY 6000 is a reasonable target. Then, the hard decisions appear as investors brace for whatever ring of investment hell awaits them in 2025: more tax-and-spend with Harris/Walz or the harsh tariff medicine of Trump/Vance.